Role

UX Writer

Team

Techcombank

Savings & Investment

Year

2021

Status

Live

Jump straight to

↓ The final result

A little back story

I grew up on Pixar films. One of my favourite sequences was Carl & Ellie’s in “Up”, where they grew up together as kids and grew their dreams of adventure together as a family. Hopes, wishes, yearnings and aspirations there contained in a tiny jar of coins on the living room shelf. It is a kind of emotional attachment and nourishment that surpasses the face value of any amount of wealth.

It is also the kind of emotional attachment and nourishment that might be lost in commercial banking products. It’s much less charming to open a term deposit than to save up for a dream.

That’s why when I was presented with the opportunity to work on the Savings Goal project, I jumped.

How I helped

- Product concept and content direction

- Copywriting for landing page and entry points

- UX writing for onboarding, set up and use flows

Overview

Savings Goal (official name: Như Ý Savings) is a unique savings product and feature on the Techcombank Mobile app. It’s unique in the sense that it is the only savings product so far at Techcombank that allows advanced personal customisation, enables manual and automatic top-up, and offers progress tracking.

Approach

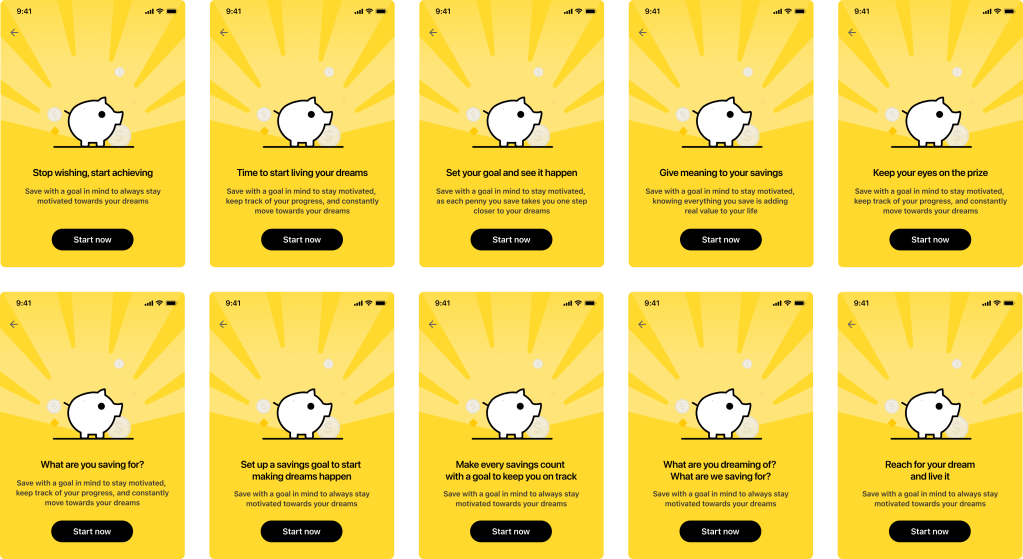

For something as unique as Savings Goal, it would be lacking to simply frame it and sell it as yet another savings product with an added top-up functionality. Our story had to begin with a narrative, which would then inform all copy decisions throughout the flow.

Savings Goal as a product naturally invited a narrative centered on goals – hopes, dreams, and aspirations. This means all promotional copy would focus on selling a dream, rather than selling added functionalities of a product.

- Copy variants for Dashboard entry point:

- Copy variants for Landing page:

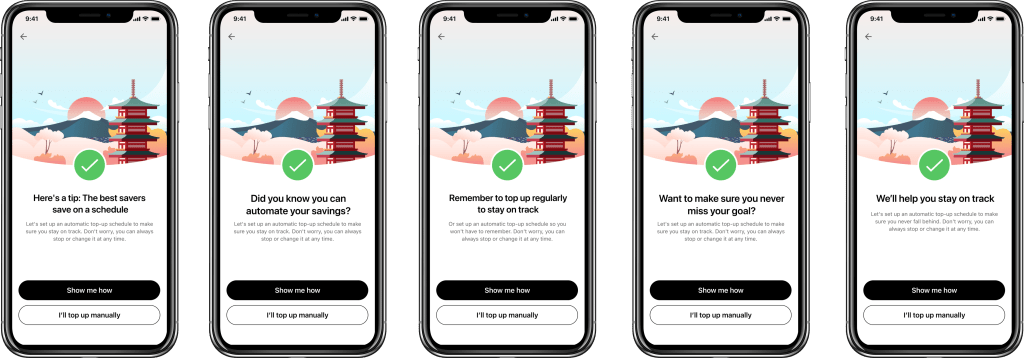

- Copy variants for Automatic Savings add-on:

This narrative also had other implications throughout the flow, most prominently:

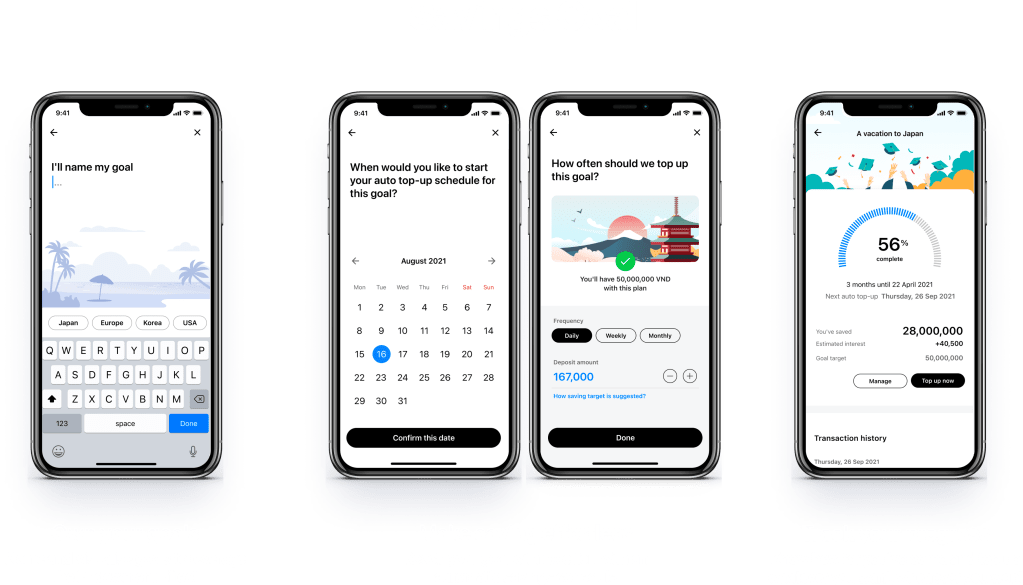

- Language used would not be “opening a term deposit” – but rather “setting a goal”

- Conversational input form would place an emphasis on “I” to subconsciously drill in the idea of ownership of goals

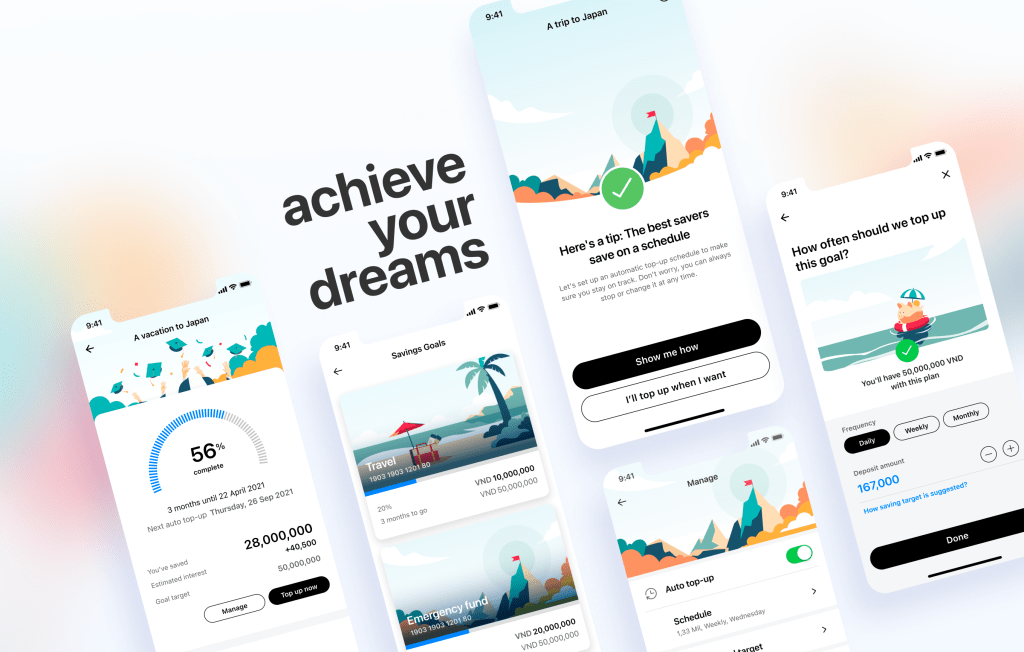

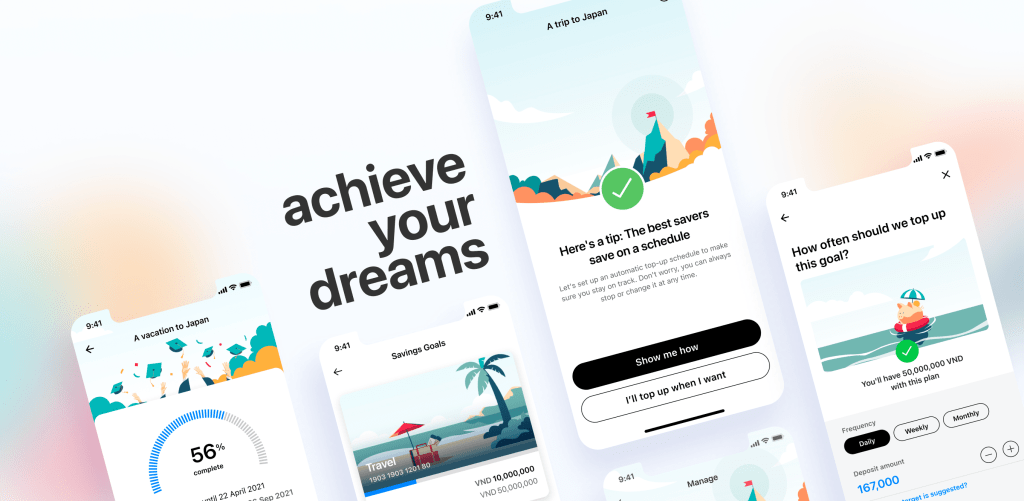

The final result

- Onboard & Set up:

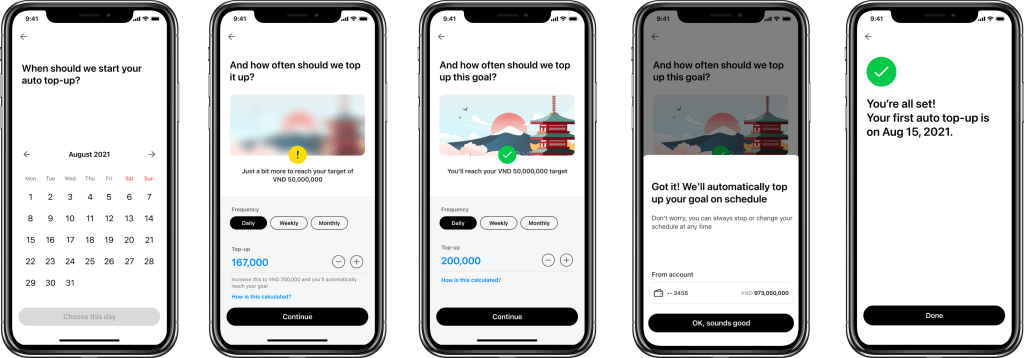

- Sign up for Automatic Savings add-on:

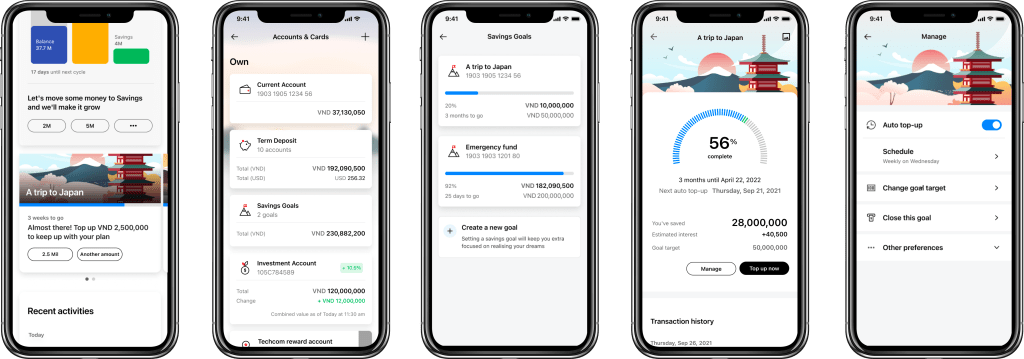

- View, track & use:

And here’s the ending

The impact of this, as shown by not just the numbers (goals created and savings volume), but also the very real names our users were giving to their thousands of goals, left us awestruck. Here was someone’s retirement fund, or savings for college, or a newlywed home, or birthday presents, health surgeries, plastic surgeries, loan repayments, gifts for parents, and more. It was an unexpected source of customer insights and VOC data.

Our team had the chance to present these results to our stakeholders and colleagues in the Digital Office, complete with the thousands of goal names we’d collected, played over the soundtrack of “Married Life” from “Up”. There was silence, then sniffles, then applause.